A home warranty is a service contract that covers repairs or replacements of home systems and appliances, whereas home insurance provides financial protection against property damage or losses caused by fire, theft, and other covered perils.

Hello, I’m Sherien Joyner, your helpful Realtor for North DFW, Texas. I’d like to explain two key aspects you’ll encounter when buying a new home or selling your home in the North DFW: home warranties and home insurance.

Though used interchangeably, they serve different purposes. It’s crucial to understand the distinction and which one best suits your property needs.

What Is a Home Warranty?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances due to normal wear and tear.

Essentially, a home warranty can be viewed as a safety net for homeowners. It’s a policy you buy that covers the cost of repairing or replacing major home systems.

These systems could include heating, electrical, plumbing, as well as appliances like dishwashers, refrigerators, and washers that experience wear and tear from everyday use.

A home warranty is like your reliable Carrollton neighbor who’s always ready to lend a hand when your oven decides to quit in the middle of Thanksgiving preparations or when the air conditioner refuses to kick in on a particularly scorching Texas summer afternoon.

I have put together a comprehensive home buyer’s guide just for you.

What Is Home Insurance?

Home insurance is a type of insurance policy that offers financial protection for a person’s home and its contents in case of damages or loss caused by covered perils such as fire, theft, or severe weather.

This means that home insurance, on the other hand, safeguards you from the financial burden of repairing or rebuilding your property if it’s damaged due to catastrophic events like fires, hailstorms, and vandalism—events beyond your immediate control.

In the larger Dallas-Fort-Worth area, where storms, and hail are frequent guests, home insurance is undeniably a must-have.

Additionally, it supports you in case of personal property loss or if someone is injured on your property.

What are the Key Differences between a Home Warranty and Home Insurance?

Home warranties cover the repair or replacement of major home systems and appliances due to normal wear and tear, while home insurance protects against sudden events or disasters like fire, theft, or natural disasters.

Think of home insurance as the protector against unforeseen, external disruptive events. In comparison, home warranties shield you from costly internal system mishaps.

Also, there’s a contrast in how they function. Home insurance is typically obligatory if you have a mortgage, while a home warranty is optional.

Insurance claims can be made as events occur, whereas home warranties go by a pre-set contract term, like annually.

Lastly, the way the costs are paid differs. Home insurance comes with a deductible, meaning you pay a certain amount out-of-pocket before your insurer pays the rest.

Home warranties require a service call fee each time a technician is dispatched to assess a situation and costs are determined by the warranty’s scope.

I have put together a comprehensive home seller’s guide just for you.

What does Home Insurance Cover?

Typically, home insurance covers four key areas: your dwelling, other structures on your premises, personal property, and liability.

The dwelling coverage takes care of your primary home, while the other structures cover sheds, detached garages, fences, or pools, among other things.

Personal property coverage ensures your belongings, like furniture, electronics, and clothing, are taken care of.

Finally, the liability coverage protects you if someone injures themselves while at your property.

What does a Home Warranty Cover?

Unlike home insurance, a home warranty is a service contract that offers discounted repairs and replacements on a home’s major components. Instead of covering your entire home, it solely focuses on systems and appliances.

The home warranty focuses on the operating systems and appliances in your home.

Depending on the plan you choose, coverage can include air conditioning, heating, plumbing, electrical systems, kitchen appliances, and even pool and spa equipment.

The concept of a home warranty is all about simplicity.

If one of your covered appliances or systems stops working, you contact your home warranty provider, pay a service fee (usually between $70 and $100), and they work with a contractor to diagnose and fix the problem, reducing the stress and cost for homeowners.

Home Warranty Covers:

1. Heating and cooling systems: Home warranties often cover repairs or replacements for malfunctioning furnaces, air conditioning units, and heat pumps.

2. Plumbing systems: This includes coverage for common plumbing issues such as leaks, clogged drains, and toilet repairs.

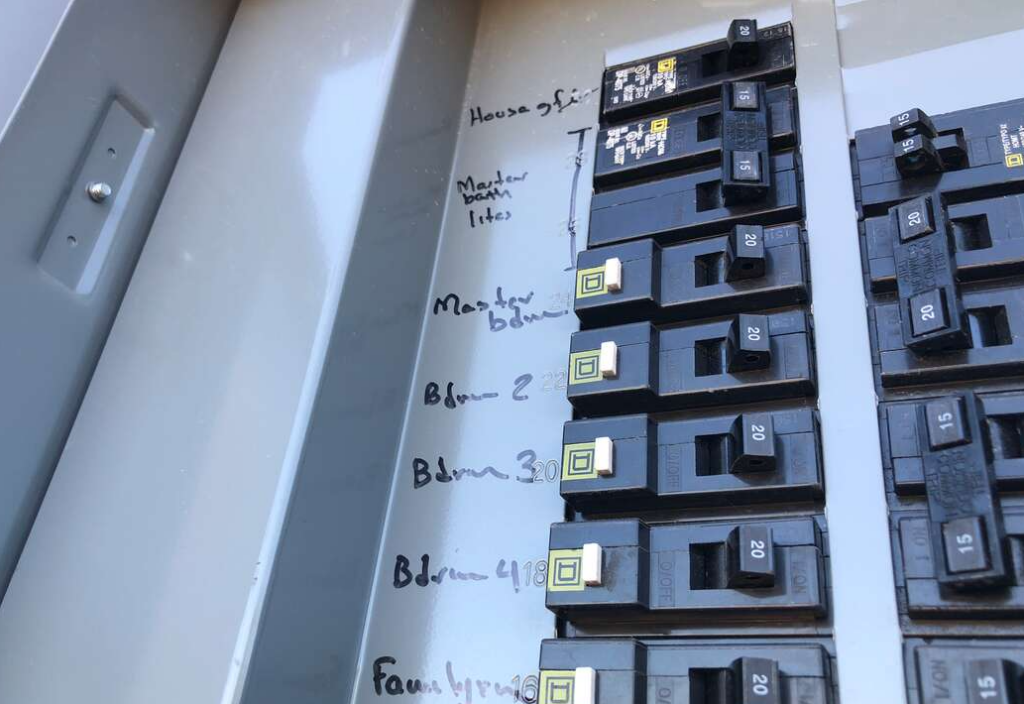

3. Electrical systems: Home warranties typically cover electrical system repairs and replacements, including faulty wiring, electrical panel issues, and malfunctioning outlets or switches.

4. Appliances: Most home warranties provide coverage for essential household appliances like refrigerators, dishwashers, ovens, and washers/dryers.

5. Water heaters: Repair or replacement of water heaters that experience a breakdown or fail to function optimally is another aspect commonly covered by home warranties.

6. Garage door openers: Some home warranty plans also offer coverage for faulty garage door openers, including repair or replacement of components such as motors, remotes, and sensors.

7. Home systems: This includes coverage for major systems, like the central vacuum system or the intercom system, depending on the specific warranty plan.

Home Insurance Covers:

1. Dwelling coverage: Home insurance typically covers the structure of your home against damage caused by covered perils such as fire, windstorm, lightning, vandalism, or theft. This coverage helps pay for the repair or rebuilding of your home.

2. Personal property coverage: Home insurance also covers personal belongings inside your home, such as furniture, appliances, electronics, clothing, and more. If they are damaged or stolen, this coverage helps cover the cost of replacement.

3. Liability coverage: Home insurance provides liability protection if someone is injured on your property or if you accidentally damage someone else’s property. It includes legal defense costs and any settlements or judgments up to the policy limits.

4. Additional living expenses: If your home is damaged and becomes uninhabitable, home insurance can cover the cost of temporary accommodation, food, and other living expenses until your home is repaired or rebuilt.

5. Medical payments coverage: Home insurance usually includes coverage for medical expenses if a guest is injured in your home, regardless of who is at fault. It can help cover their immediate medical costs, such as emergency room visits, x-rays, or doctor’s fees.

6. Loss of use coverage: If your home is uninhabitable due to covered damage, loss of use coverage helps pay

Debating Home Warranty Versus Home Insurance

It isn’t a matter of either/or when deciding between home warranties and home insurance. In fact, it is beneficial to have both.

Having home insurance checks your fundamental needs of protecting your property from calamities that can leave significant financial strain.

A home warranty serves as a supplementary layer of defense focusing on the working parts within the structure that consume a large chunk of your budget when failing.

Also, for those owning older homes in cities like Carrollton, complete with their unique charm but also an array of age-related mechanical troubles, home warranties offer added security.

I would be thrilled to help you with any of your real estate needs. Whether you’re looking to buy, sell, or just need some guidance, I’m here to assist you every step of the way.

Final Thoughts

In the booming real estate landscape of North DFW, Texas, expertise is vital.

As a seasoned Realtor, I recommend considering both home warranties and home insurance for a comprehensive financial protection plan for your home, whether you’re nestled in Denton or living in downtown Dallas.

Inform yourself, make comparisons, and analyze your specific needs before making a decision.

Feel free to reach out to me, Sherien Joyner, for any further information or assistance needed as you navigate the real estate waters of North DFW.

In the challenging but rewarding process of buying or selling a home, remember, it’s the details that count, and understanding home warranties versus home insurance is a significant piece of the puzzle.