Ad Valorem: A Deeper Look

Understand that when we talk about ‘Ad Valorem’ in property taxes, we’re talking about a tax based on the assessed value of an item, such as real estate or personal property.

In the context of home ownership, ad valorem refers to the tax levied on your house by the local government, which is based on your property’s value.

Calculation of Ad Valorem Taxes

One of the first questions you probably have is, how is this tax calculated?

It’s important to know that the ad valorem tax isn’t calculated using the market value of your home—the amount your home would sell for on the open market. Instead, it uses the assessed value, a valuation set by the local tax assessor.

This value is often a percentage of the market value and varies by county and state.

Once the assessed value is determined, the tax rate (often expressed as a mill rate – one mill is equal to one dollar per $1,000 of assessed value) is applied.

For instance, if your home has an assessed value of $200,000 and your tax rate is 20 mills, your ad valorem tax for the year would be $4,000.

Factors That Affect Ad Valorem Taxes

Several factors can influence the amount of ad valorem tax you’ll pay.

The assessed value of your property, which considers factors like the size of the property, the age of the home, and any renovations or improvements, is the primary determinant.

The local tax rate also plays a critical role. Each local government body, including counties, municipalities, and school districts, sets its own mill rate.

If you’re in an area with a high mill rate, you’ll likely pay more in property taxes.

Property exemptions can lower your tax burden as well. For example, in Texas, homeowners can apply for a homestead exemption, which reduces the value of the property for tax purposes.

Other exemptions might be available for seniors, veterans, or disabled individuals.

I have put together a comprehensive home buyer’s guide just for you.

Appealing Your Ad Valorem Taxes

If you believe that your property has been overvalued by the assessor, leading to higher ad valorem taxes, you might have the option to appeal the assessment.

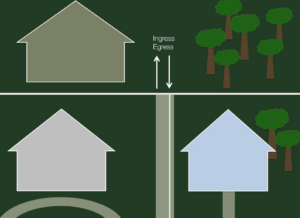

This usually involves demonstrating that the assessed value does not reflect the actual value of your property, often by comparing your property to similar properties with lower assessments.

Ad Valorem Tax vs. Other Property Taxes

Many homeowners get ad valorem tax confused with other types of property taxes because they’re both typically billed and collected at the same time. However, ad valorem tax differs in that it is directly tied to the value of a property.

Other property taxes, such as special assessment taxes, are typically used to fund specific projects or services and are not associated with the value of the property.

The Role of Ad Valorem Taxes

While ad valorem taxes can seem like a burden, they serve an important role in helping local governments fund essential services.

The tax revenues derived from ad valorem taxes help pay for public schools, road maintenance, police and fire departments, and other essential local services.

I would be thrilled to help you with any of your real estate needs. Whether you’re looking to buy, sell, or just need some guidance, I’m here to assist you every step of the way.

Effect on Property Purchase Decisions

It’s crucial to consider the impact of ad valorem taxes when buying a property.

While a more expensive home might be more appealing, remember that its higher value will likely result in higher ad valorem taxes. Consider this when determining your budget for a new home.

Understanding ad valorem can make property taxation seem less like a mysterious labyrinth and more like a navigable road. It’s always ideal to know what to expect when it comes to taxes before buying a new home.

The clearer picture you have of your potential tax commitment, the better equipped you are to make informed decisions in your home buying journey.

As your North Dallas realtor, I’m here to help make that journey as smooth as possible. Please feel free to contact me, Sherien Joyner if I can answer any questions!

Popular FAQ's

What is ad valorem taxation in property taxes?

Ad valorem taxation is a method used to calculate property taxes based on the assessed value of a property.

It means that the property taxes you pay are determined by the estimated value of your property.

How is the assessed value of a property determined for ad valorem taxation?

The assessed value of a property is determined by a local government assessor who evaluates various factors such as the size, location, condition, and market value of the property.

This assessment is usually conducted periodically, such as annually or every few years.

Are there any exemptions or deductions available for ad valorem property taxes?

Yes, many jurisdictions provide exemptions or deductions for certain property owners, such as homeowners, senior citizens, veterans, or individuals with disabilities.

These exemptions or deductions can reduce the assessed value of the property and subsequently lower the amount of property taxes owed.

How often do property taxes based on ad valorem assessments change?

Property taxes can change annually or periodically, depending on the local government’s assessment cycle and tax rate changes.

Additionally, if there are significant changes to the property, such as renovations or additions, it may trigger a reassessment of the property value.

Can I appeal the assessed value of my property for ad valorem property taxes?

Yes, in most jurisdictions property owners have the right to appeal the assessed value of their property if they believe it is inaccurate or unfair.

There is usually a specific process and timeline for appealing assessments, which involves providing evidence to support your claim. It’s important to check with your local tax authority for specific instructions.